When buying a home, there are many costs associated with the purchase. One of the most important is closing costs. Closing costs are the fees you pay to get your mortgage and finalize the purchase of your home. They can add up to a significant amount of money, so it’s important to understand what they are and how to best prepare for them.

This article will provide you with a comprehensive guide to understanding and preparing for closing costs in Nassau County, NY. We will discuss each cost type and how much you can expect to pay on average. We will also provide some tips on how to save money on closing costs.

So, whether you are in the process of buying or selling a home or just want to be better prepared for when you do, read on to learn everything you need to know about closing costs in Nassau County.

The Closing Costs in Nassau City, NY

In Nassau City, both the buyer and the seller pay the closing costs. However, the most common arrangement is for the buyer to pay most of the costs and the seller to pay a smaller portion.

This is because the closing costs are generally associated with getting a mortgage and finalizing the purchase, which are tasks typically undertaken by the buyer.

The details of the payment structure are usually specified in the contract of sale to avoid any confusion between the buyer and the seller.

Let’s look at the buyer’s closing cost, the seller’s closing cost, and other general costs associated with a real estate transaction in Nassau County.

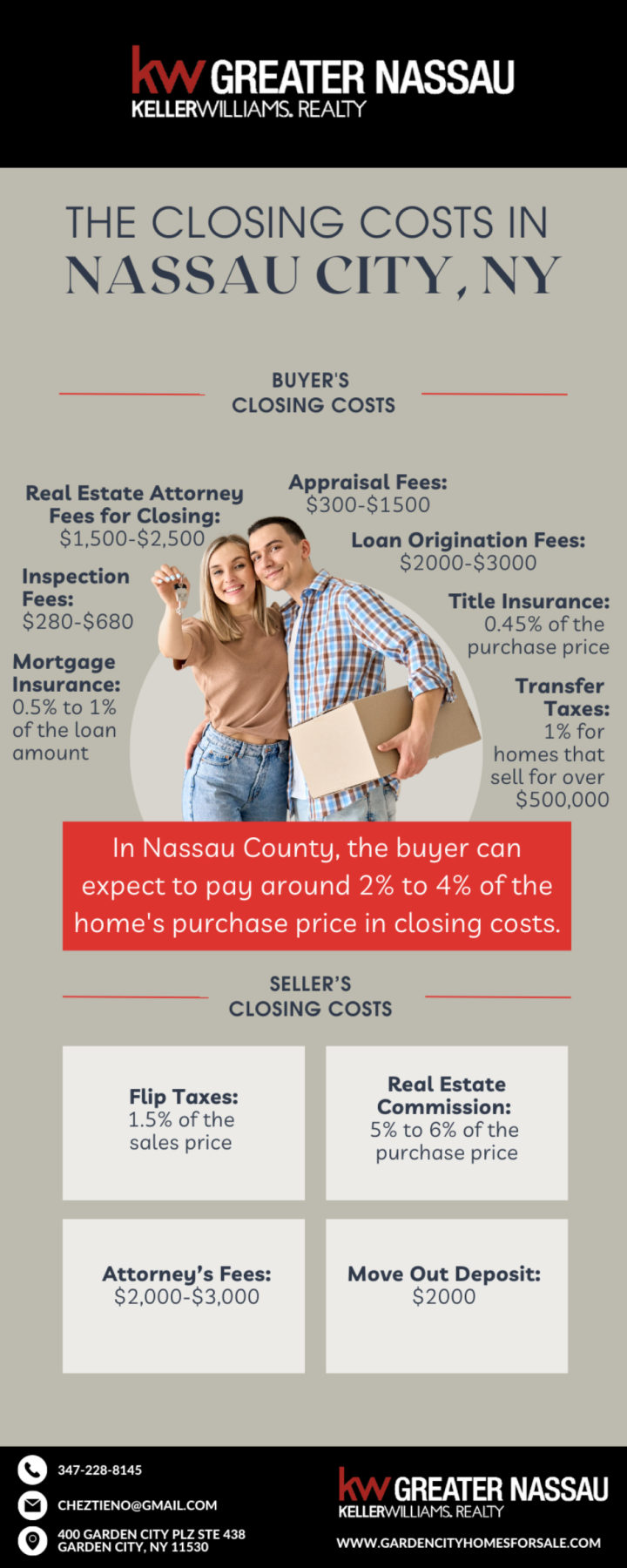

Buyer's Closing Costs

In Nassau County, the buyer can expect to pay around 2% to 4% of the home’s purchase price in closing costs. This means that on a $400,000 home, you would be looking at closing costs amounting to approximately $8,000 to $16,000.

However, for someone in the market to buy a condo or townhouse that costs over a million dollars, the buyer’s closing costs are estimated at 3% to 4% of the purchase price.

The exact amount will vary depending on the specifics of your purchase, such as the type of mortgage you get and the fees associated with it. It’s a good idea to talk to your lender about what you can expect to pay in closing costs so you can budget accordingly.

Some of the most common closing costs for buyers include:

Loan Origination Fees

This is a fee charged by the lender for processing your loan application. It is typically a percentage of the loan amount so it will be higher for larger loans. Generally, you can expect to pay $2,000 to $3,000.

Appraisal Fees

If you are getting a mortgage, your lender will require an appraisal of the property to ensure it is worth at least as much as the loan amount. The appraiser will typically charge $300 to $1,500 for this service.

Inspection Fees

It is also common for the lender to require a home inspection to ensure that the property is in good condition. The inspector will charge a fee for their services, typically around $280 to $680.

Title Insurance

This insurance protects the lender from any issues with the property’s title. Lenders usually require it if you’re taking out a mortgage for a condo in Nassau County.

However, if you’re purchasing a co-op, this insurance is unnecessary because of the individual shareholder setup. The cost of title insurance is typically 0.45% of the purchase price.

Real Estate Attorney Fees for Closing

A buyer might hire an attorney to represent them during the closing process. The attorney’s fees will vary depending on the complexity of the transaction and their experience level. You can expect to pay around $1,500 to $2,500 for an experienced real estate attorney in Nassau County.

Transfer Taxes

If you are purchasing a property in Nassau County, you may be responsible for paying transfer taxes. This is a tax that is levied by the state and county on real estate transactions.

Any property purchase in Nassau County, NYC, over $500,000 is subject to a transfer tax of 1% of the home sale price. While any purchase worth $500,000 or less is subject to a 1.425% transfer tax.

Homeowner's Insurance

Once you purchase a home, you must get homeowner’s insurance to protect your investment. The cost of the insurance will vary depending on the value of your home and the amount of coverage you choose.

Prepaid Property Taxes

Sometimes, you may be responsible for paying the seller’s property taxes at closing. This is typically the case if the seller has already paid their property taxes for the year, as the buyer will be responsible for the taxes from closing onward.

The lender typically escrows prepaid taxes, so you will not have to pay them upfront. However, they will be added to your monthly mortgage payment.

Mortgage Insurance

If you put less than 20% down on a home, you will likely be required to purchase PMI (private mortgage insurance). This insurance protects the lender in case you default on your loan. The cost of PMI varies, but it is typically around 0.5% to 1% of the loan amount.

For example, if you’re taking out a $200,000 loan with 10% down, your PMI would cost $2,000 per year or $167 per month.

Prepaid Interest

When you close on a mortgage, you will be responsible for paying interest from the closing date to the end of that month. For example, if you close on your loan on June 15th, you will owe interest for the remainder of the month of June.

The lender will typically collect this interest at closing, so you will not have to pay it upfront, but it will be added to your first mortgage payment.

Seller's Closing Costs

While the buyer is generally responsible for most of the closing costs, there are costs that are typically paid by the seller.

Real Estate Commission

The most common seller’s closing cost is the real estate commission, a fee that the listing agent charges to sell the property. This fee is typically around 5% to 6% of the purchase price and is split between the listing agent and the buyer’s agent.

For example, the real estate commission on a $500,000 home would be $25,000. The listing agent would typically keep $15,000, and the buyer’s agent would keep $10,000.

If you want to avoid paying the real estate commission altogether, you can choose to list your home for sale yourself (FSBO).

Transfer Taxes

If you sell a property in Nassau County, you may be responsible for paying transfer taxes: the New York State transfer tax and the real property transfer tax.

The New York state transfer tax is 0.4% to 0.7% of the sales price and is paid by the seller. The real property transfer tax is 1% to 1.5% of the sales price. In addition to this tax, you will have to pay a $100 filing fee.

Flip Taxes

Some co-ops in New York City charge a flip tax, which is a fee that must be paid by the seller when the property is sold. The flip tax is typically 1.5% of the sales price and is paid by the seller at closing.

You should only pay a flip tax if the co-op lease documents say so. In some situations, the person buying your home will be responsible for the flip tax, so you won’t have to pay it.

Attorney’s Fees

If you have an attorney to represent you in selling your home, they will charge you a fee for their services. Attorney’s fees typically range from $2,000 to $3,000 and are paid by the seller at closing.

Move Out Deposit

If you live in a co-op or condo, you may have to pay a move out deposit when you sell your home. This deposit is generally equal to one month’s maintenance fee and is paid by the seller at closing. You should budget around $2,000 for this deposit.

What Are the Most Critical Factors When Reducing Your Closing Costs in Nassau City, NY?

One of the most critical factors in reducing closing costs is ensuring you understand all the fees you will be responsible for. Several different fees can be charged at closing, and it’s important to be aware of them so you can negotiate accordingly.

Additionally, getting the seller to pay some closing costs is often possible, so it’s important to ask about this when negotiating the sale.

Finally, if you’re using a real estate agent, they may be able to help you reduce your closing costs by getting the seller to pay some of the fees.

Average Closing Costs Nassau County, NY

Given the average home sale price in Nassau County, NYC which is $685,000, the average closing costs is $17,125. This includes the real estate commission, the New York State transfer tax, the real property transfer tax, attorney’s fees, etc.

Final Thoughts

As someone who understands that buying a home is a huge investment, I make sure that I am always updated on the market trends, closing costs, real estate laws, and everything related to home buying or selling that might affect my clients.

If you’re looking to buy or sell a home in Nassau County, NY, I would be more than happy to help you through the process and answer any questions you may have. Feel free to contact me anytime.

Frequently Asked Questions

How much are closing costs in Nassau County?

On average, you can expect to pay around $17,125 in closing costs when buying a home in Nassau County.

What is the percentage for closing costs on a home in Nassau County?

Closing costs in Nassau County is typically 2% to 4% of the home’s purchase price. This includes the real estate commission, transfer taxes, attorney’s fees, etc.

Which party typically pays for the closing costs?

The seller usually pays for the real estate commission, which is 5% to 6% of the home’s purchase price. The buyer is typically responsible for the rest of the closing costs, which include transfer taxes, attorney’s fees, etc.

What are some of the most common fees associated with closing costs?

The most common fees associated with closing costs are the real estate commission, transfer taxes, attorney’s fees, and the loan origination fee.

Why is Nassau County so expensive?

Nassau county is expensive because it is one of the most desirable places to live on Long Island. It has great schools, jobs, and a low crime rate.

How can I save on closing costs in Nassau City, NY?

One of the best ways to save on closing costs is to use a real estate agent. An experienced agent will know how to negotiate with the seller to get them to pay some of the fees. Additionally, they may get the seller to pay some of the buyers’ closing costs.

How can I reduce my closing costs in Nassau City, NY?

The best way to reduce closing costs is to be aware of all the fees you will be responsible for. You should know the fees you may have to pay at closing so you can negotiate accordingly. Additionally, getting the seller to pay some closing costs is often possible, so it’s important to ask about this when negotiating the sale.